Insight Hub

Stay updated with the latest trends and insights.

Think All Insurance is the Same? Think Again!

Discover why not all insurance is created equal! Uncover the secrets to finding the best coverage for your needs today.

The Hidden Differences: How Insurance Policies Can Vary Widely

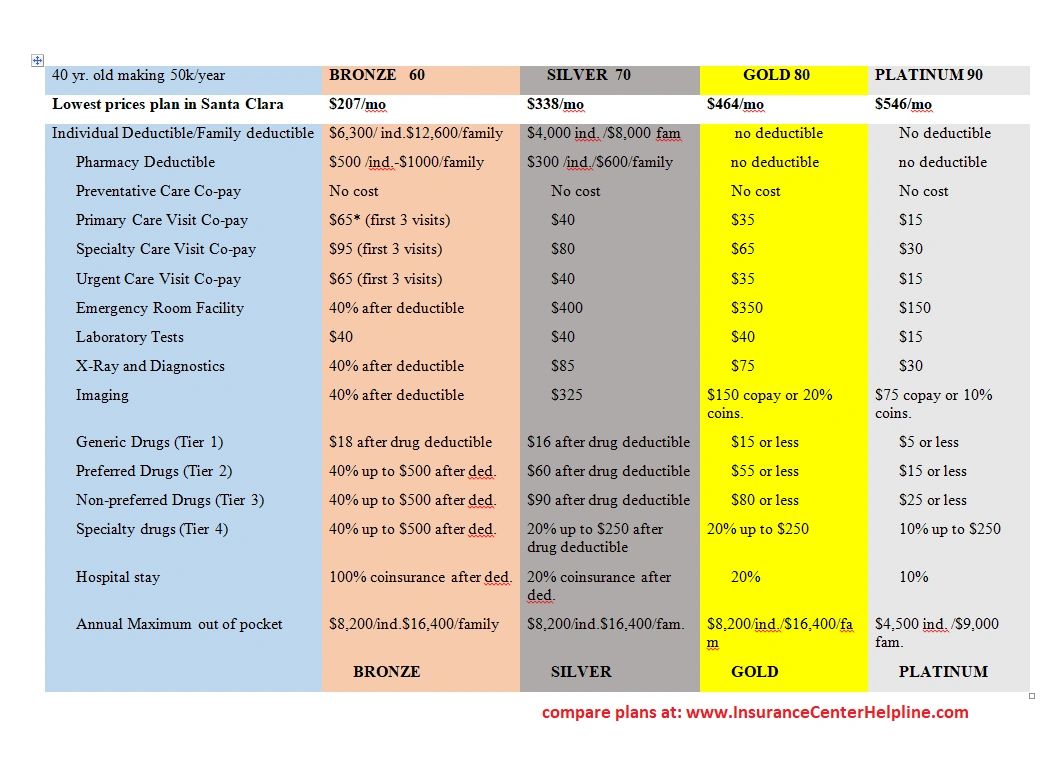

When it comes to purchasing insurance policies, understanding the hidden differences between them is crucial for consumers. While many people assume that all insurance policies are relatively similar, the reality is that coverage, exclusions, and costs can vary widely from one provider to another. For example, a health insurance plan might offer a low premium but come with high deductibles, while another provider could charge more upfront but provide comprehensive coverage with lower out-of-pocket expenses.

Additionally, the terms and conditions of insurance policies often include complex fine print that can significantly affect the policyholder's experience. Elements such as waiting periods, limits on claims, and specific exclusions can differ extensively. Shopping around and thoroughly reviewing different options is essential. Always pay close attention to the policy's details to ensure that you are selecting a plan that truly meets your needs and offers the best value for your money.

What You Need to Know: Common Myths About Insurance Types

Insurance is often surrounded by numerous misconceptions that can lead to misguided decisions. One common myth is that health insurance is only necessary for those with chronic conditions. In reality, everyone should consider having health coverage, as unexpected accidents or illnesses can arise at any time. For instance, according to a report, nearly 66% of bankruptcies are linked to medical expenses, emphasizing that insurance plays a crucial role in providing financial security.

Another prevalent belief is that life insurance is only for older individuals or those with families. This misconception can prevent young adults from securing coverage early on, which could lead to significant cost savings. In fact, obtaining life insurance at a younger age can lock in lower premiums and provide peace of mind against unforeseen circumstances. It's important to dispel these myths and understand that insurance serves as a protective measure, regardless of one’s current life stage.

Are You Really Covered? Understanding the Fine Print of Your Insurance

When it comes to insurance, many people often assume they are fully covered without understanding the specifics of their policy. However, the truth often lies within the fine print. Regularly reviewing your insurance policy and asking questions about terms that are unclear is crucial. For instance, what is your deductible, and how does it affect your overall coverage? Are there specific exclusions or limitations mentioned in the policy? Understanding these details can make a significant difference when you need to file a claim.

Additionally, it's essential to consider factors that may impact your coverage in the future. Changes in circumstances, such as renovations to your home or a new driver in your household, can affect your insurance needs. Familiarizing yourself with your insurer's claims process and customer service options can also help prepare you for any eventualities. Ultimately, a proactive approach to managing your insurance means being aware of not only what is covered but also the conditions that may bring unforeseen limitations.