Insight Hub

Stay updated with the latest trends and insights.

Renters Insurance: Your Safety Net for Life's Little Surprises

Protect your peace of mind! Discover how renters insurance can shield you from life's unexpected surprises. Don't miss out!

What Does Renters Insurance Cover? A Comprehensive Guide

Renters insurance is a vital safeguard for individuals who rent their homes. It provides financial protection against various risks that could lead to significant losses. Typically, renters insurance covers personal property against perils such as fire, theft, and vandalism. This means that if your belongings, like furniture, electronics, or clothing, are damaged or stolen, your insurance can help reimburse you for their value. Additionally, renters insurance can cover additional living expenses if you are temporarily unable to live in your home due to a covered event, providing you with peace of mind during recovery.

Aside from protecting personal property, renters insurance often includes personal liability coverage. This is crucial if someone is injured in your rented space or if you accidentally damage someone else's property. For instance, if a guest slips and falls in your apartment, this insurance can help cover their medical expenses and legal fees. Finally, most policies also offer medical payments coverage, which can help pay for minor injuries sustained by visitors, regardless of fault. Understanding these coverages is key to ensuring you're adequately protected as a renter.

Top 5 Reasons Why Every Renter Needs Insurance

As a renter, securing your belongings and ensuring peace of mind should be a top priority. Here are the top 5 reasons why every renter needs insurance:

- Protection Against Theft: Renter’s insurance provides crucial protection against lost or stolen property. Whether it's a laptop, smartphone, or cherished family heirloom, knowing that you have coverage in case of theft is invaluable.

- Liability Coverage: Accidents happen. If someone gets injured in your rented space, you could be held responsible. Renter’s insurance typically includes liability coverage, safeguarding you from potential legal fees.

- Natural Disaster Coverage: From floods to fire, unexpected events can cause significant damage to your personal belongings. Renter’s insurance helps cover repair or replacement costs.

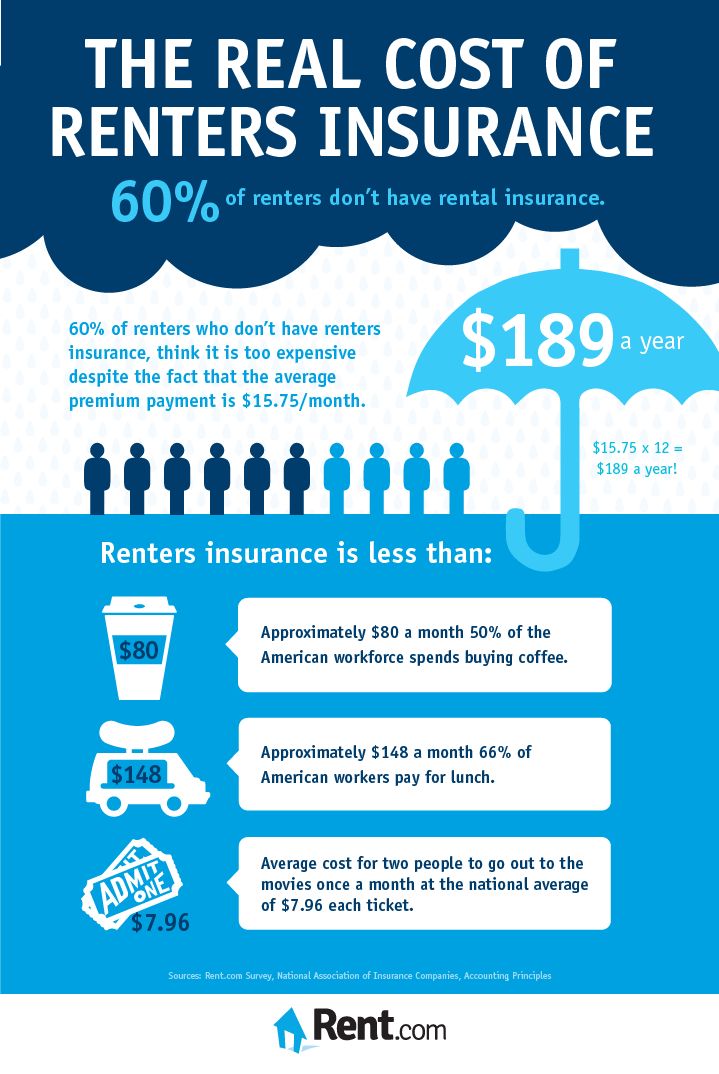

- Affordable Monthly Premiums: Many renters assume insurance is too expensive, but it’s often quite affordable. For a relatively low monthly fee, you can secure substantial coverage.

- Peace of Mind: Ultimately, knowing that you are protected against unforeseen circumstances offers invaluable peace of mind, allowing you to focus on enjoying your home.

How to Choose the Right Renters Insurance Policy for Your Needs

Choosing the right renters insurance policy can feel overwhelming, but understanding your needs is the first step. Begin by assessing the value of your personal belongings, such as electronics, furniture, and clothing. Make a comprehensive list and estimate their total worth. This will help you determine the level of coverage required. Additionally, consider any potential liabilities that could arise while renting, such as accidental damages to the property or injuries to visitors. Understanding these factors will aid you in finding a policy that adequately addresses your unique circumstances.

Once you know what you need, it’s essential to compare different renters insurance policies to find the best fit. Look for policies that offer replacement cost coverage rather than actual cash value, as this will ensure you receive a fair payout in the event of a loss. Pay attention to the policy limits and deductibles, as a lower premium may result in higher out-of-pocket costs when filing a claim. Finally, read customer reviews and seek recommendations to gauge the reliability and responsiveness of different insurance providers. This due diligence can save you time, money, and stress in the long run.