Insight Hub

Stay updated with the latest trends and insights.

Crypto Compliance Chronicles: Tales from the Frontlines

Explore the thrilling world of crypto compliance! Join us for real stories and insights from the frontlines of the digital currency revolution.

Navigating the Regulatory Landscape: Key Compliance Challenges in the Crypto Space

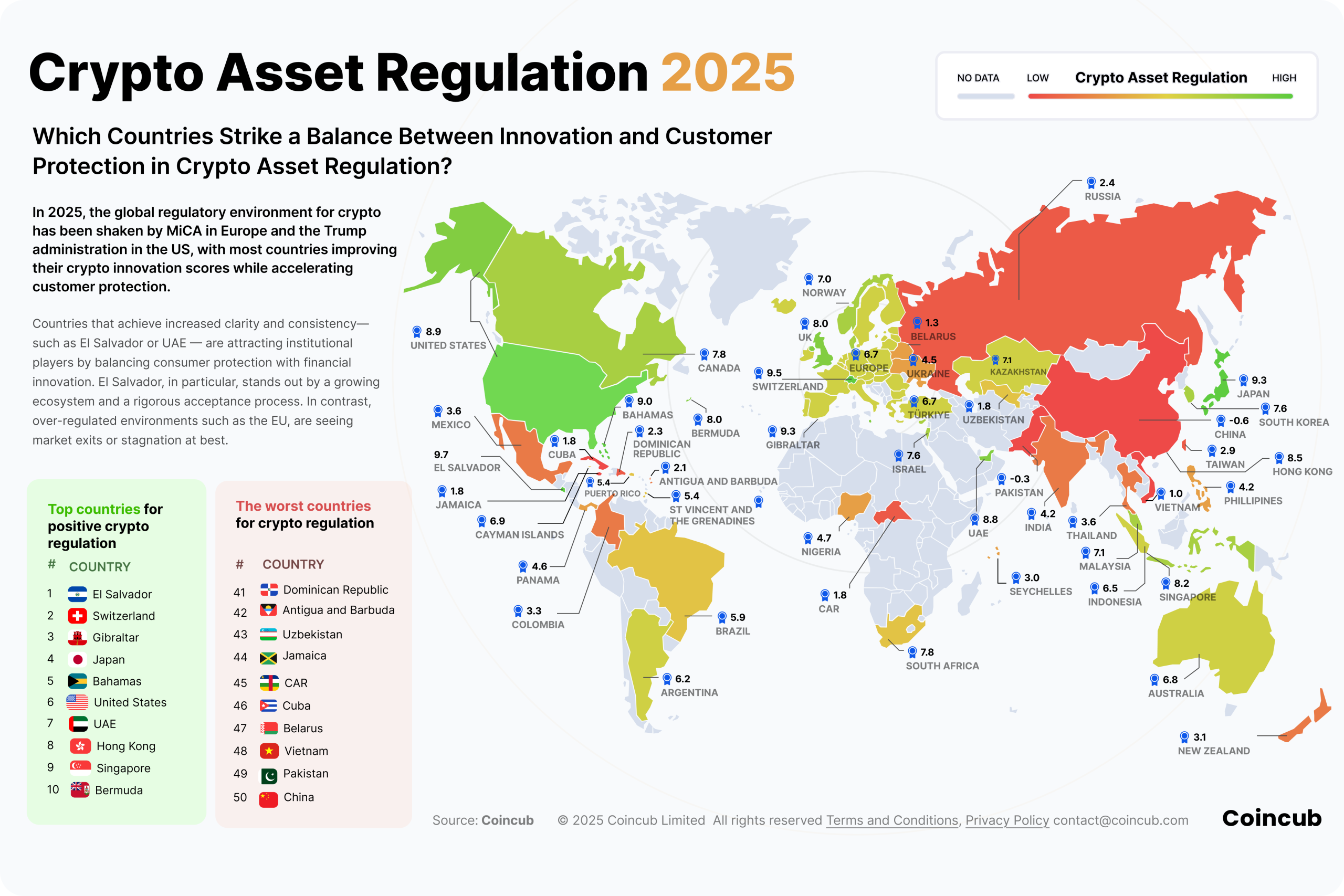

As the cryptocurrency market continues to evolve, navigating the regulatory landscape poses significant challenges for businesses and investors alike. One of the primary compliance hurdles is the differing regulatory frameworks across various jurisdictions. For instance, in the United States, the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have distinct guidelines that impact how cryptocurrencies are classified and traded. This creates confusion, as firms must tailor their operations to adhere to local regulations while remaining agile in a global market. Furthermore, the need for anti-money laundering (AML) and know your customer (KYC) compliance adds another layer of complexity, requiring businesses to implement rigorous verification processes to mitigate risks.

Additionally, emerging regulations such as the General Data Protection Regulation (GDPR) in Europe impose strict rules on data privacy, forcing cryptocurrency organizations to rethink their data management strategies. This can lead to a conflict between the principles of decentralization fundamental to many cryptocurrencies and the centralized compliance frameworks demanded by regulators. Regulatory uncertainty not only affects strategic planning but also impacts investor confidence. To effectively navigate these challenges, industry players must maintain up-to-date knowledge of regulatory changes and proactively adjust to ensure compliance while fostering innovation in their offerings. By embracing transparency and engaging with regulatory bodies, crypto businesses can better position themselves in this rapidly changing landscape.

Counter-Strike is a popular multiplayer first-person shooter game where teams of terrorists and counter-terrorists compete to complete objectives or eliminate each other. Players can enhance their gaming experience through various promotions, including using a betpanda promo code to gain bonuses. With its competitive gameplay and tactical strategy, Counter-Strike has become a favorite among eSports enthusiasts worldwide.

From Exchange to Wallet: Understanding the Compliance Obligations for Cryptocurrency Businesses

The transition from exchange to wallet in the cryptocurrency landscape is fraught with compliance obligations that businesses must navigate with care. As regulations continue to evolve, it becomes imperative for cryptocurrency businesses to understand their responsibilities, which include implementing Know Your Customer (KYC) measures, Anti-Money Laundering (AML) policies, and adhering to data protection laws. Failure to comply with these requirements can lead to significant penalties, loss of reputation, and the potential for criminal charges. Therefore, companies must prioritize robust compliance strategies that align with local and international laws.

In addition to KYC and AML, businesses must also pay attention to the security of wallet services. This involves ensuring that customer funds are protected through measures such as two-factor authentication, regular audits, and transparent operational practices. Establishing a clear policy on compliance not only fosters trust among users but also positions the business for long-term success in a highly regulated market. As the regulatory landscape continues to change, staying informed and proactive will be key for any cryptocurrency business looking to thrive.

What Happens When Compliance Fails? Real-Life Case Studies of Crypto Regulation Violations

When compliance fails in the cryptocurrency space, the repercussions can be severe, affecting not just the companies involved but also the entire market. One notable example is the case of Bitfinex, a cryptocurrency exchange that faced legal challenges for allegedly mishandling customer funds and failing to register as a money services business. The New York Attorney General filed a lawsuit against Bitfinex, highlighting the risks posed to investors and the market's integrity due to lax compliance measures. This case illustrates how regulatory bodies are increasingly willing to take action against non-compliant entities, leading to significant financial penalties and loss of consumer trust.

Another striking instance is the ICO (Initial Coin Offering) boom of 2017-2018, where numerous startups launched tokens without proper regulatory oversight. A prominent case is that of Centra Tech, whose founders were charged with fraud for misleading investors regarding their compliance with U.S. laws. The SEC alleged that the company falsely claimed partnerships with major financial institutions and raised over $25 million before the project collapsed. Such cases not only highlight the failure of compliance but also serve as cautionary tales for potential investors, emphasizing the importance of regulatory adherence in maintaining a stable and trustworthy cryptocurrency ecosystem.