Insight Hub

Stay updated with the latest trends and insights.

Skinning the Cat: Navigating Risk in Trade Management

Discover unconventional strategies for managing trade risks and turn challenges into opportunities in Skinning the Cat!

Understanding the Risks: Key Factors in Trade Management

Understanding the risks involved in trade management is crucial for any business or investor. Key factors include market volatility, which refers to the fluctuations in asset prices that can significantly impact trade outcomes. Monitoring economic indicators, such as inflation rates and interest rates, can help traders anticipate market movements. Additionally, geopolitical events, like political instability or trade wars, can also introduce unforeseen risks that need to be managed effectively. Hence, incorporating a strong risk assessment strategy is essential to mitigate potential losses.

Another important aspect of trade management is implementing robust risk mitigation strategies. This involves setting clear stop-loss orders and limit orders to protect against sudden market shifts. Traders should also diversify their portfolios to spread risk across different assets and sectors. Regularly reviewing trading performance and adjusting strategies based on past outcomes can provide valuable insights and help in making informed decisions moving forward. Ultimately, a thorough understanding of these key factors can empower traders to navigate the complexities of financial markets successfully.

Counter-Strike is a highly popular tactical first-person shooter that emphasizes teamwork and strategy. Players can engage in various game modes, with the objective often revolving around completing missions or eliminating the opposing team. For those interested in improving their trading skills in the game, a valuable resource is the trade reversal guide, which provides insights on how to navigate the marketplace effectively.

Top Strategies for Mitigating Risk in Trading

When it comes to trading, mitigating risk is critical to maintaining both profitability and sustainability in the market. One of the top strategies is to implement a diversified portfolio. By investing in a mix of asset classes, such as stocks, bonds, and commodities, traders can spread their risk and minimize the impact of poor performance from any single investment. Additionally, regularly rebalancing your portfolio to align with your risk tolerance can help manage exposure and reduce volatility.

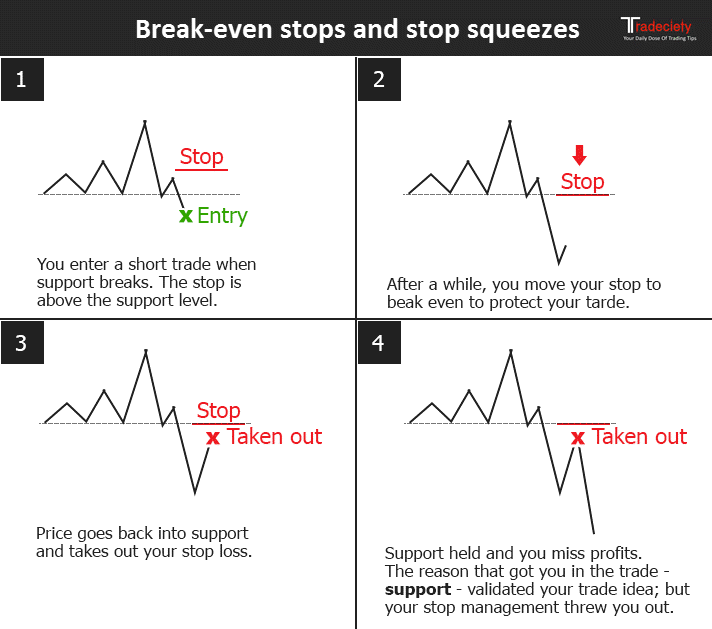

Another effective strategy is to utilize stop-loss orders, which automatically sell an asset when it reaches a predetermined price. This not only protects your downside but also allows you to stick to your trading plan without the emotional bias that can cloud judgment during market fluctuations. Creating a comprehensive risk management plan, which includes setting clear trading goals and limits, is essential in creating a disciplined approach to trading. By adopting these strategies, traders can effectively mitigate risk and enhance their chances of success in the financial markets.

How to Assess Risk vs. Reward in Your Trading Decisions

Assessing risk vs. reward in trading is crucial for making informed decisions that can significantly impact your financial outcomes. To start, consider using a systematic approach that involves both quantitative and qualitative analysis. You can utilize the following steps to evaluate your potential trades:

- Identify your risk tolerance: Understand how much risk you are willing to take based on your trading style and financial situation.

- Calculate potential returns: Analyze the expected gains versus the amount you are risking. This ratio will help you determine if the trade is worth pursuing.

- Conduct market research: Gather information about the asset, market trends, and external factors that could affect your trade.

Once you have gathered enough data, it is essential to create a plan that outlines your strategy for each trade. This should include specific entry and exit points, as well as predetermined stop-loss levels to minimize potential losses. Remember, the objective is to maximize your reward while managing your risk. A well-documented approach not only aids in making rational decisions but also helps in refining your trading tactics over time. In conclusion, a thorough assessment of risk vs. reward paves the way for effective trading, encouraging discipline and a strategic mindset that are key to long-term success.